Magento extension Quack BB - Banco do Brasil by haphaews

MageCloud partnered with haphaews to offer Quack BB - Banco do Brasil in your MageCloud panel for our simple 1-click installation option. To install this extension - create your account with MageCloud and launch a new Magento store. It takes only 3 minutes.

haphaews always provides support for customers who have installed Quack BB - Banco do Brasil Magento module. Feel free to leave a review for the company and the extension so we can offer you better products and services in the future.

You may want to check other haphaews Magento extensions available at MageCloud and even get extensions from hundreds of other Magento developers using our marketplace.

Allows the store to receive payments through the Banco do Brasil e-commerce API.

Compatible with Magento 1.x

Quack BB - Banco do Brasil

Payment module for the Brazil Bank customers.

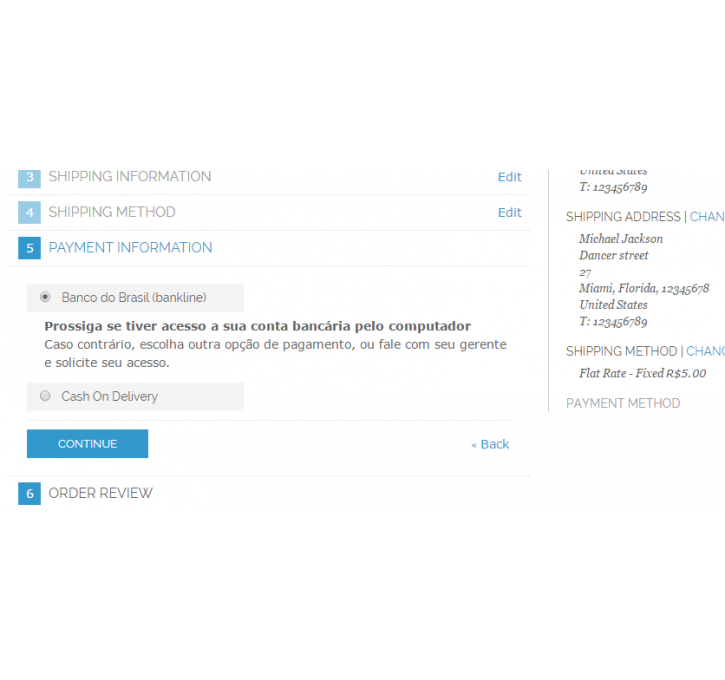

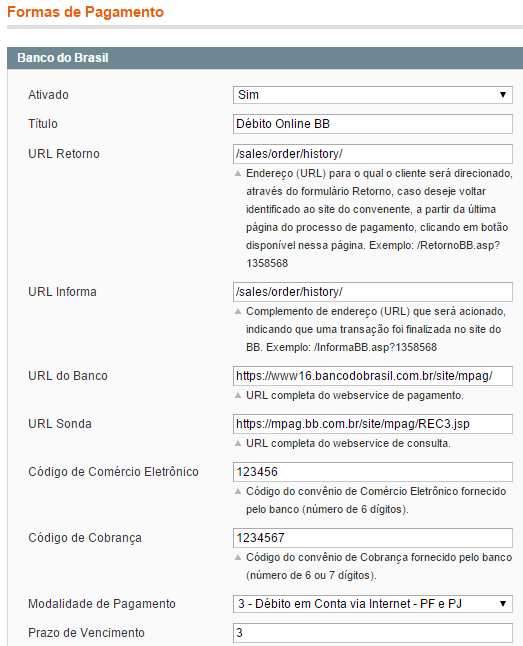

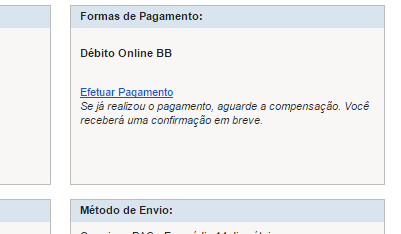

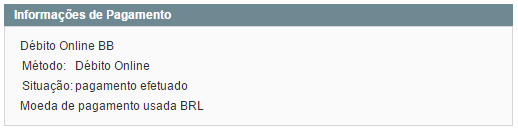

The module allows you to receive payments from Banco do Brasil (Brazil Bank). It was developed according to the bank official documentation. After installed a new payment option is displayed to the customer during the checkout. When the order is placed the customer is redirected to the bank environment and should login with his credentials. The bank transfers the amount to the store at the end. This extension updates and invoices paid transactions automatically too.

Benefits

- Invoices payments automatically (no manual invoice required).

- Third party free and gateways free (bank account required).

- Extension totally free (free of taxes, free of paid versions, free of advertisements)

Requirements

- Being customer's bank (Banco do Brasil)

- Assign the e-commerce bank terms

Módulo de pagamentos Banco do Brasil para Magento.

Desenvolvido a partir do Manual de Orientações Técnicas, fornecido pelo Banco do Brasil. Após instalado, este módulo fornece a opção de pagamento através do BB. Ao finalizar a compra, o cliente é direcionado para o ambiente do banco, e deve realizar o acesso online ao banco. Em seguida o banco recebe e transfere o montante à loja. A extensão também verifica periodicamente pelos pagamentos recebidos, e gera a fatura automaticamente.

Benefícios

- Confirma pagamentos de forma automática (menos trabalho para o logista).

- Livre de intermediários